In modern lending, "Time to Yes" is the biggest competitive advantage. Yet, most underwriters still manually key in data from PDF bank statements to calculate debt-to-income ratios.

DocsRouter allows you to feed raw PDFs into an automated underwriting engine.

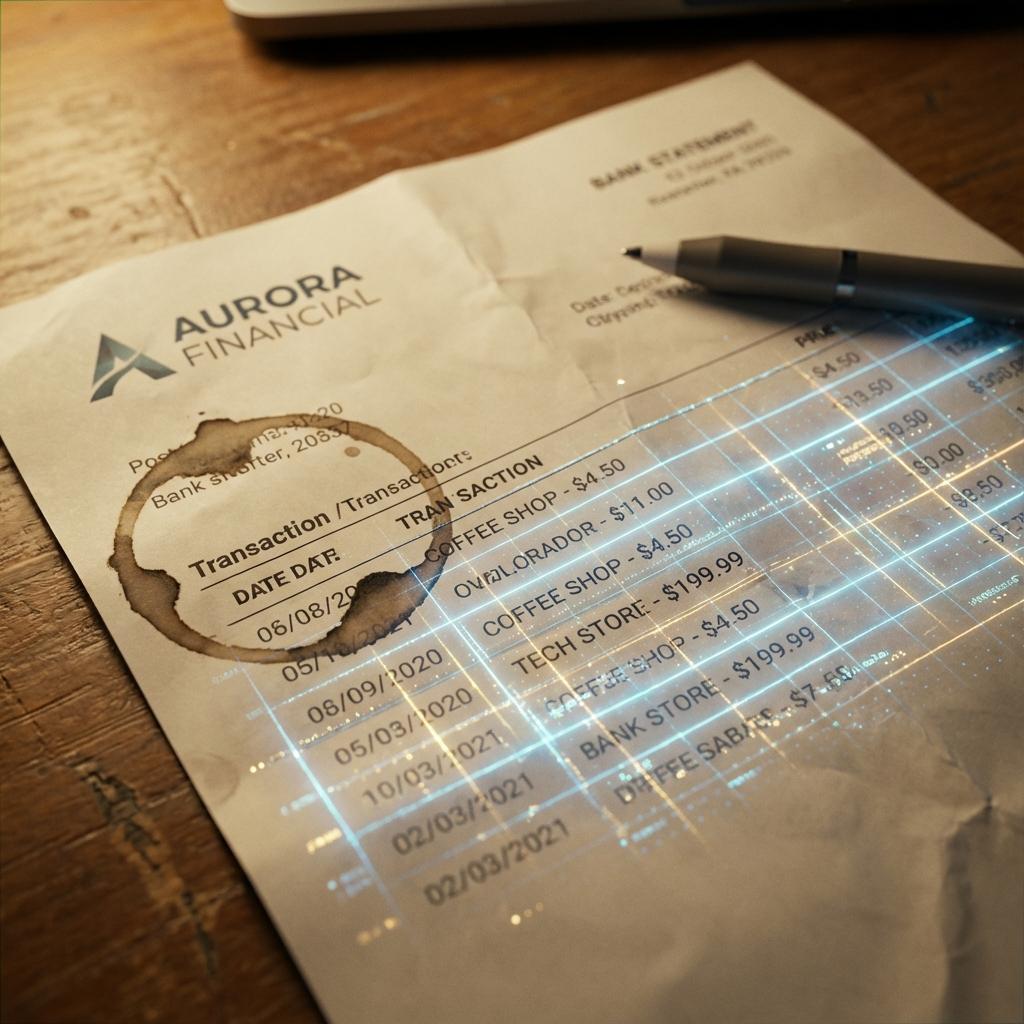

Table Reconstruction

Bank statements are essentially massive, multi-page tables. They are also messy. Transactions wrap to new lines. Headers repeat on every page.

DocsRouter uses a Layout-Aware approach.

It identifies the header row (Date | Description | Debit | Credit | Balance) and intelligently stitches transactions that span multiple lines.

Fraud Detection: The "Coffee Stain" Test

Digital fraud is rising. It's easy to Photoshop a PDF to add an extra '0' to your balance. However, Photoshopped PDFs leave metadata traces.

DocsRouter performs Forensic Analysis on every upload.

- Font Consistency: "Is this '0' the same font as the other numbers?"

- Layer Analysis: "Are there hidden layers or masks?"

Cash Flow Categorization

Once we extract the transaction rows, we don't just give you raw text. We categorize it.

STARBUCKS #1254-> Category: Dining/CoffeeSTRIPE TRANSFER-> Category: Business Income

This allows you to instantly see a borrower's Net Operating Income (NOI) without opening Excel.